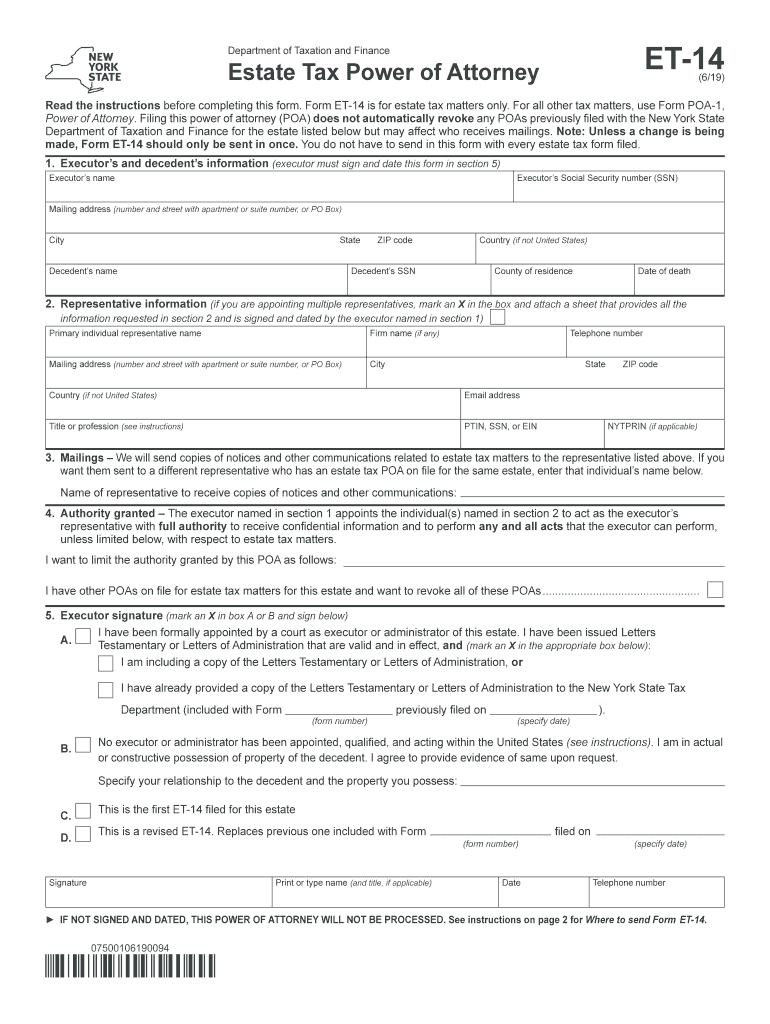

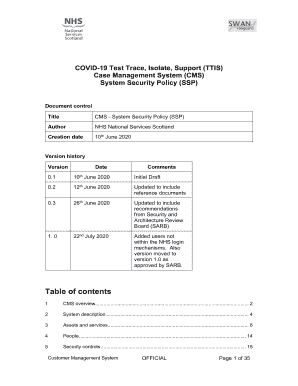

What is ET-14 form?

Use Form ET-14, Estate Tax Power of Attorney, when you want to give one or more individuals the authority to obligate, bind, or appear on your behalf before the New York State Department of Taxation and Finance (the department) with respect to estate tax matters. For all other tax matters related to the estate or decedent, use Form POA-1, Power of Attorney.

Who should file ET-14 form?

You do not need Form ET-14 to authorize someone to appear with you, or to authorize someone to provide information, or prepare a report or return for you. You may only appoint individuals (not a firm) to represent you. Authorizing someone to represent you by a power of attorney (POA) does not relieve you of your tax obligations. Unless you limit the authority you grant, your appointed representatives may perform any and all acts you can perform, including but not limited to: receiving confidential information concerning your taxes, agreeing to extend the time to assess tax, agreeing to a tax adjustment, and establishing an installment payment agreement for taxes owed.

Is ET-14 form accompanied by other documents?

Form ET-14 must be signed and dated by the executor. Form ET-14 should be submitted with your completed Form ET-30, Application for Release(s) of Estate Tax Lien, Form ET-85, New York State Estate Tax Certification, Form ET-90, New York State Estate Tax Return, Form ET-95, Claim for Refund of New York State Estate Tax, Form ET-130, Tentative Payment of Estate Tax, Form ET-133, Application of Extension of Time To File and/or Pay Estate Tax, or Form ET-706, New York State Estate Tax Return.

What information do I provide in ET-14 form?

-

Section 1 — Executor’s and decedent’s information

-

Section 2 — Representative information

-

Section 3 — Mailings

-

Section 4 — Authority granted

-

Section 5 — Executor signature, and definition of executor

Executor’s and decedent’s information (Executor’s name, Executor’s social security number (SSN), Mailing address (number and street with apartment or suite number, or PO Box), Country (if not United States), Decedent’s name, Decedent’s SSN, County of residence, Date of death. Representative information (if you are appointing multiple representatives, mark an X in the box and attach a sheet that provides all the information requested in section 2 and is signed by the executor named in section 1) Mailings — We will send copies of notices and other communications related to estate tax matters to the representative listed above. If you want them sent to a different representative who has an estate tax POA on file for the same estate, enter that individual’s name below. Authority granted — The executor named in section 1 appoints the individual(s) named in section 2 to act as the executor’s representative with full authority to receive confidential information and to perform any and all acts that the executor can perform, unless limited below, with respect to estate tax matters. Executor signature (mark an X in box A or B and sign below).

When and Where do I send ET-14 form?

FAX to: (518) 435-8406 (the easiest and fastest method)

Mail to: NYS TAX DEPARTMENT POA CENTRAL W A HARRIMAN CAMPUS ALBANY NY 12227-0864